Commercial Fishing Industry

Mississippi Commercial Fishing

Commercial fishing corresponds to finfish and shellfish fishing in the North American Industrial Classification System (NAICS). Finfish fishing comprises establishments primarily engaged in the commercial catching or taking finfish (e.g., menhaden, redfish, snapper, seatrout, flounder, mullet, and sheepshead) from their natural habitat. Shellfish fishing comprises establishments primarily engaged in the commercial catching or taking shellfish (e.g., blue crab, oyster, shrimp) from their natural habitat.

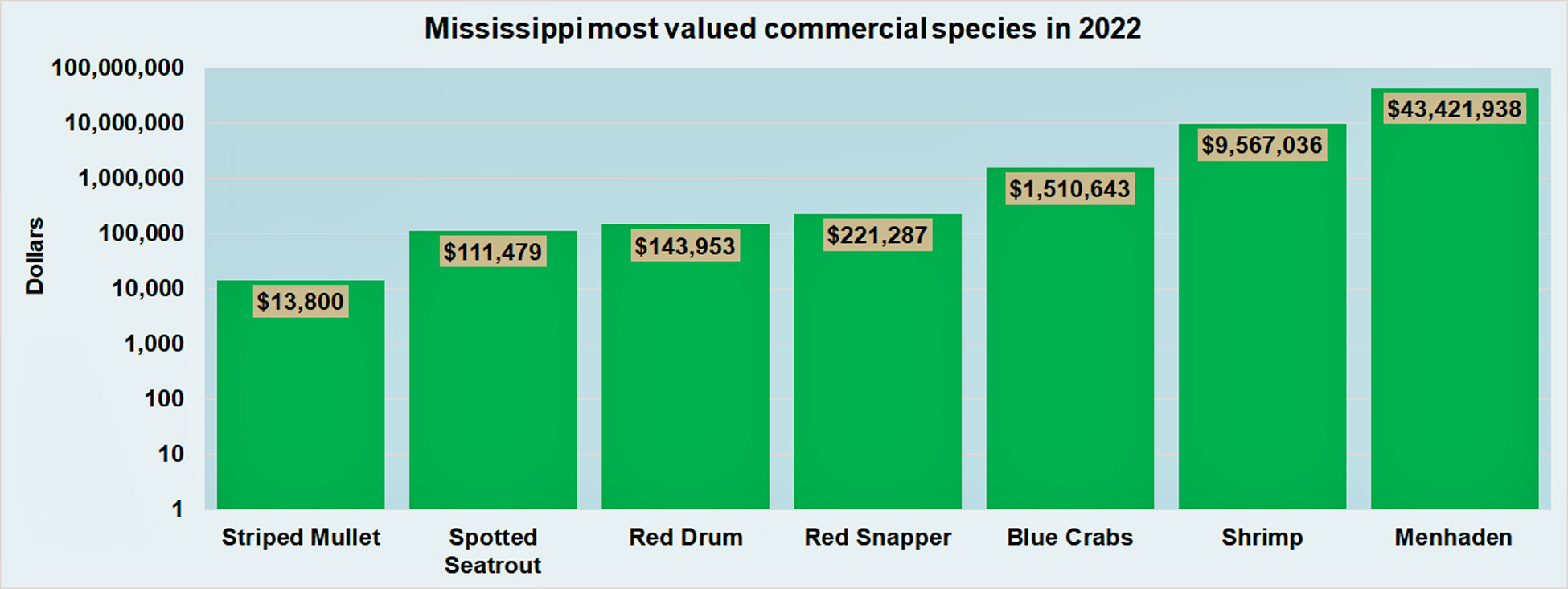

Fig. 1 shows the most valued species landed by Mississippi commercial fishermen in 2022. Menhaden was the most valued species, valued at $43.4 million or 78.7 percent of the total landing values. Brown and white shrimp added $9.5 million, or 17.3 percent. Blue crabs came in third most valued species with $1.5 million in dockside sales or 2.7 percent. Red snapper, red drum, spotted seatrout, and striped mullet added 1.3 percent to the total dockside values in 2022. No commercial landings of oysters from Mississippi public reefs have been reported since 2019.

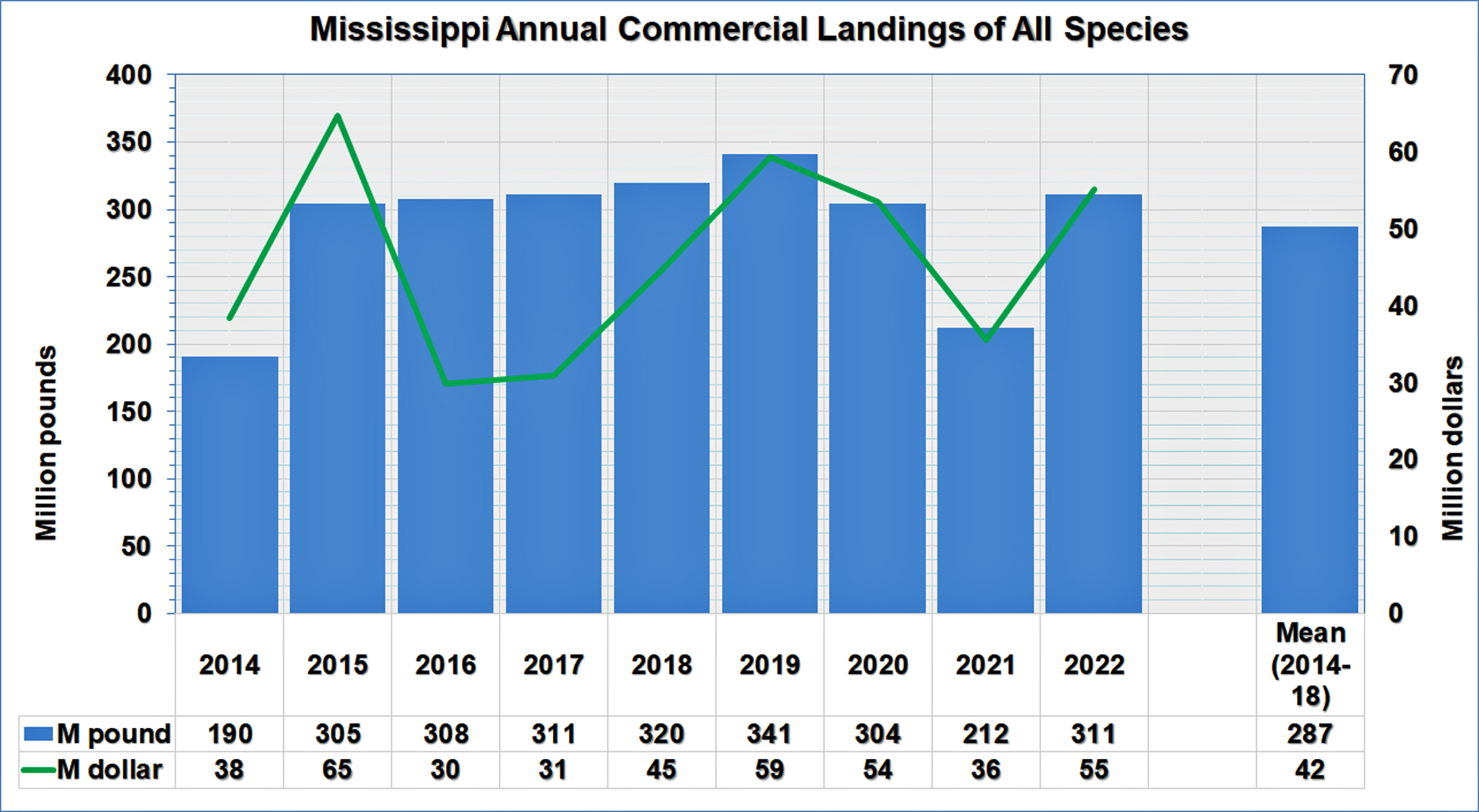

Commercial landings averaged 287 million pounds during the selected benchmark period and were valued at $42 million (Fig. 2). Commercial landings and dockside values in 2021 were significantly lower than the benchmark values in 2014-18.

Commercial fishing generated economic activities and provided jobs in the coastal counties. Output or sales are the gross sales by businesses within the economic region affected by an activity.

The total economic impact is the sum of direct, indirect, and induced impacts. Direct effects express the economic impacts in the sector where the expenditure was initially made. Indirect impacts result from changes in the economic activity of other industrial sectors that supply goods or services to the sector being evaluated. Induced impacts result from industry employees' personal consumption expenditures (IMPLAN, 2024).

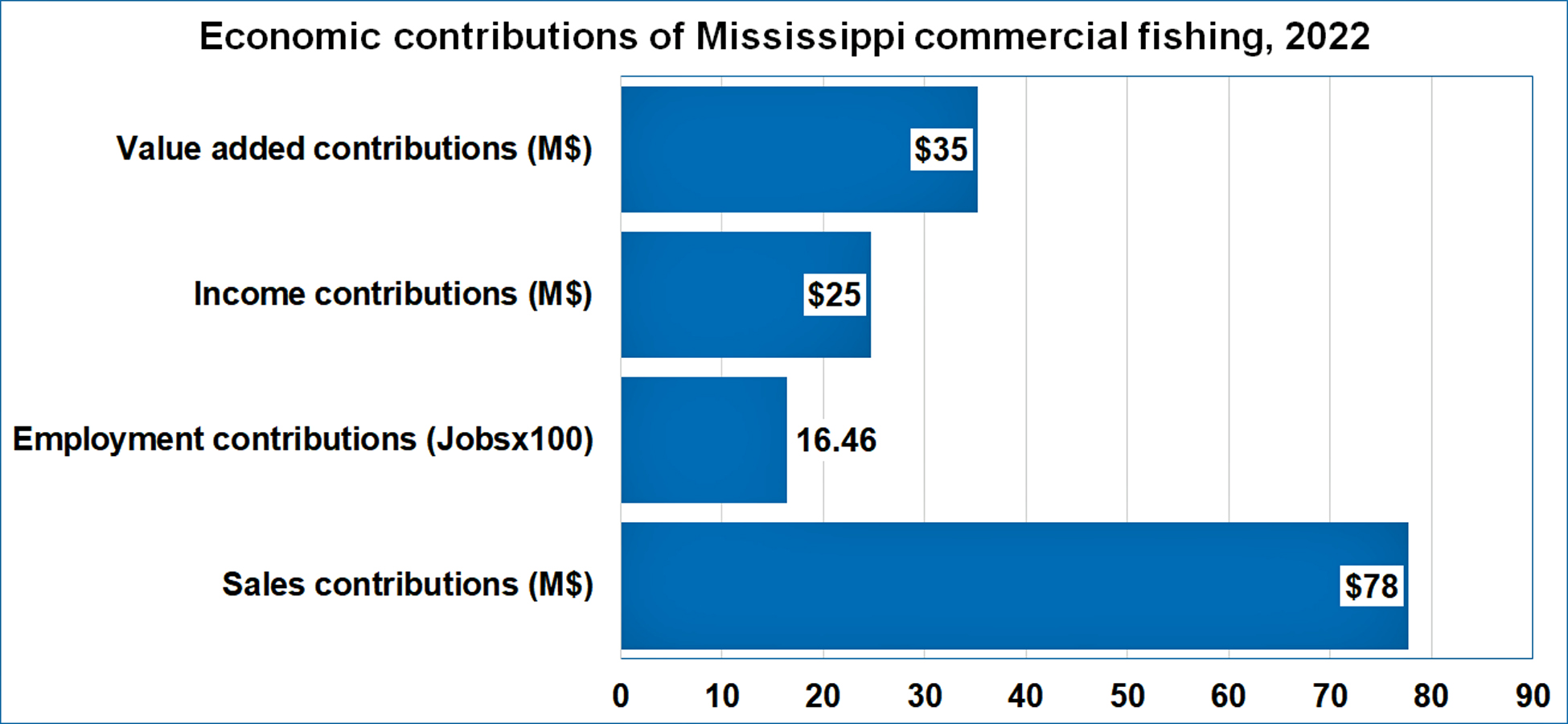

The economic contributions of Mississippi commercial fishing are shown in Fig. 3. The sales contribution of the commercial fishery was about $78 million, representing about 24 percent of the entire seafood industry's sales contribution to the state's economy.

Employment or job contributions are expressed in a mix of full-time and part-time jobs. The industry created more than 1,600 full-time and part-time jobs, which represent about 24 percent of the seafood industry's total job economic contribution in Mississippi.

Value-added contribution measures an industry's contribution to the gross domestic product. It is the difference between an Industry's total output and the costs of its intermediate inputs (IMPLAN, 2024). The value-added contribution of commercial fishing reached $35 million.

The income contribution of commercial fishing reached $24 million. Labor income consists of all forms of employment income, including employee compensation -- wages, salaries, and benefit and proprietor income (IMPLAN, 2024).

Annual data from Lightcast (2024) indicate more than 1,300 Mississippi commercial fishermen and owners. About 4.3 percent are women. Three-fourths are White, 10.4 percent are African Americans, 7.5 percent are Hispanic, 3.7 percent are Asians, and 1.9 percent have two or more races. The rest are American Indians and Native Hawaiians.

The average age of Mississippi commercial fishermen and owners was 43 years old. About 24 percent were less than 34 years old. About 54 percent were between 35 and 54 years old. The 55-year-old and higher commercial fishermen and owners comprised 22 percent.

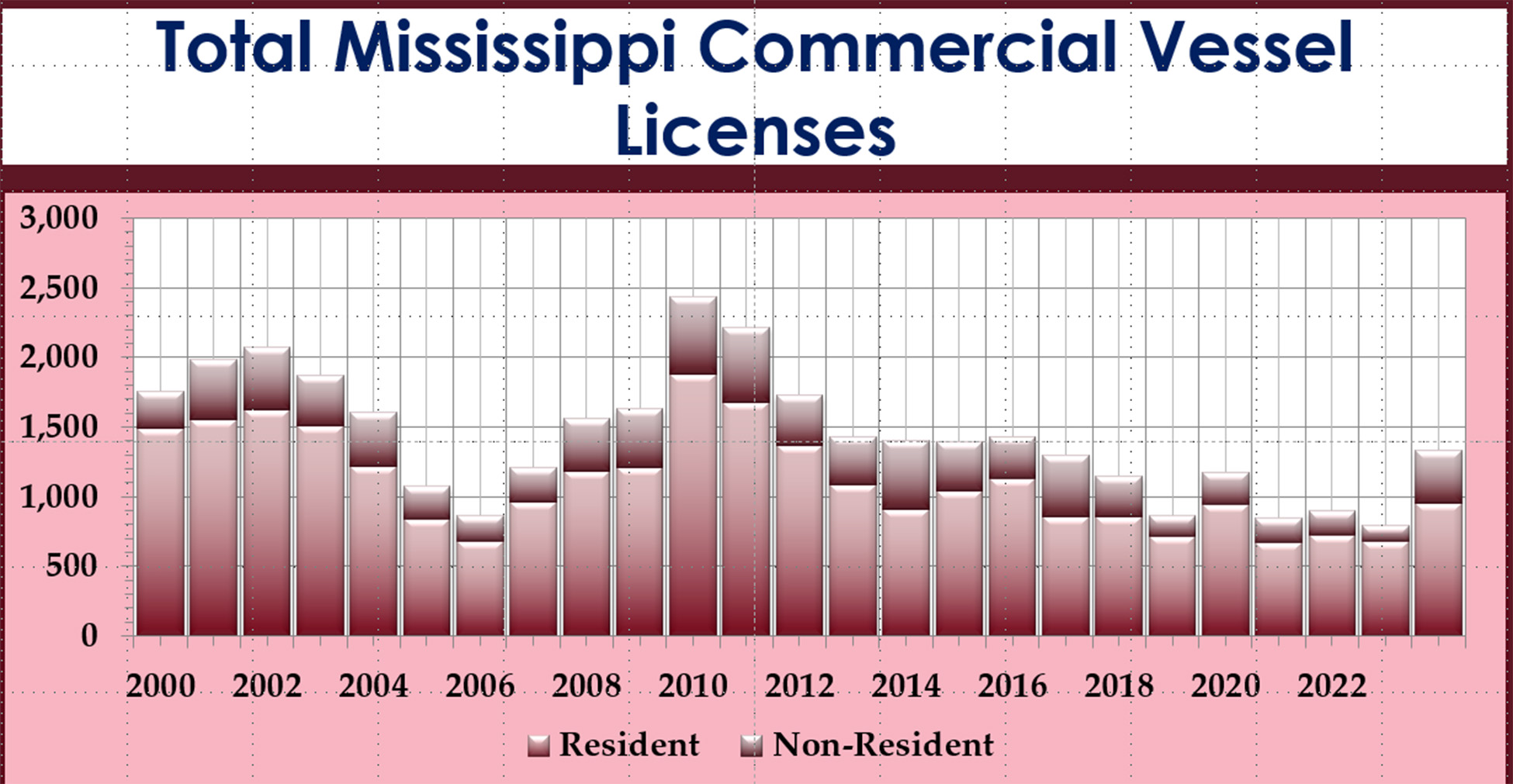

The total number of commercial fishing licenses issued by the Mississippi Department of Marine Resources were sold to commercial vessels fishing for crabs, shrimp, oysters, hook and line, and menhaden (Fig. 4). These commercial licenses for fishing vessels are sold to residents and non-residents.

Natural and man-made disasters adversely affected commercial fishing activities, which seemed to have considerably declined during the pandemic years. The total number of commercial fishing vessel licenses significantly fell after Hurricane Katrina in 2005 and remained low in succeeding years.

The surge in the total number of commercial fishing vessel licenses in 2010, despite the disastrous Deepwater Horizon oil spill in the Gulf of Mexico, was motivated by the opportunity for them to participate in the Vessel of Opportunity (VOO) program. The VOO program became available to boat owners who could not fish or use large parts of the Gulf of Mexico due to the oil spill. Boat owners were compensated for their participation in the cleanup by skimming, booming, and transporting supplies.

A noticeable decline was seen after the opening of the Bonnet Carre Spillway in 2011 and then again in 2019. Overall, the total number of commercial fishing vessel licenses sold in recent years remained below the pre-disaster years in early 2000.

Publications

News

RAYMOND, Miss. -- For Mississippi’s commercial fishermen, stress is part of daily life, but the typical stressors they face have been intensifying for more than 10 years.

LAPLACE, La.

While the U.S. Army Corps of Engineers is closing the Bonnet Carré Spillway this week, economic impacts of its months-long opening are expected to be felt in the seafood industry for years to come.